All the sessions from Transform 2021 are out there on-demand now. Watch now.

Titan has raised $58 million to construct an investment management platform to take on the likes of Fidelity and other classic investment funds.

The corporation aims to allow daily investors access to investment specialists — as properly as its personal cryptocurrency, Titan Crypto.

Andreessen Horowitz (A16z) led the round with participation from current investors like General Catalyst, BoxGroup, and Ashton Kutcher’s Sound Ventures.

Titan mentioned that what Fidelity and its iconic mutual funds have been for infant boomers, Titan is for a new generations of investors, the corporation mentioned.

Other investors incorporated pro athletes and celebrities, like Odell Beckham Jr., Kevin Durant, Jared Leto, and Will Smith. Anish Acharya, an A16z common companion, will be joining Titan’s board.

To date, New York-based Titan has raised $75 million to assistance the mission to lead the world to improved wealth by enabling absolutely everyone to invest in the world’s accomplishment. The funds will be used to construct out Titan’s underlying platform and suite of investment items, alongside scaling core functional teams.

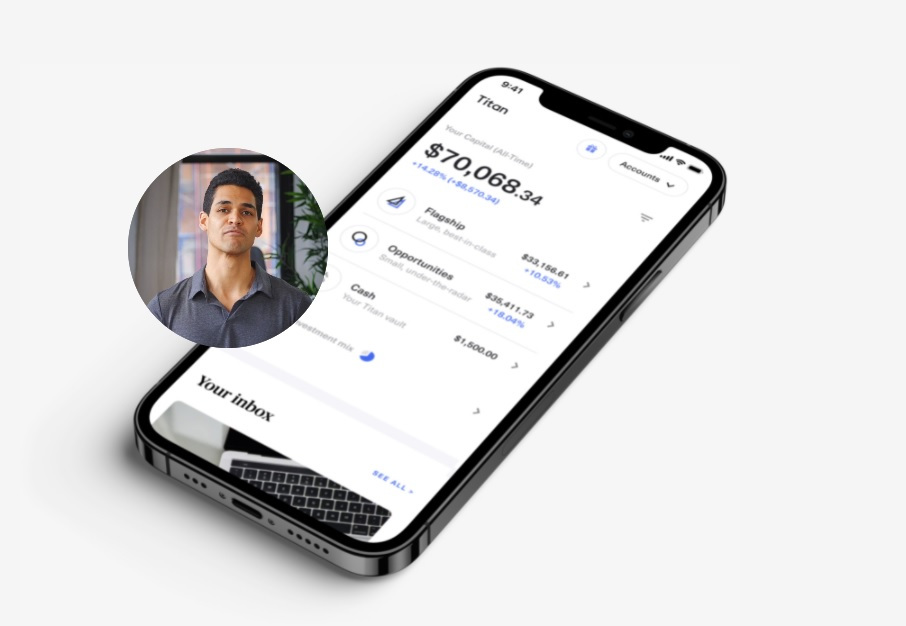

Titan is the 1st direct-to-customer (DTC), mobile-1st investment platform exactly where daily investors, irrespective of wealth, can have their capital actively managed by investment specialists in lengthy-term methods. Like investment giants ahead of it, the initial methods on Titan’s platform are predominantly in stocks (for instance, its significant-cap development method referred to as “Flagship” is a contemporary version of the revered Magellan Fund). But the platform is rapidly expanding into other asset classes, getting into new territory exactly where legacy players have but to tread.

Joe Percoco, CEO of Titan, mentioned in an e mail to VentureBeat that classic investment management tools are like the tech equivalents of VHS videotapes.

“After years on Wall Street helping the rich get richer, we were bothered by the divide between institutional and retail investors,” Percoco mentioned. “We were telling our own family and friends to invest in the ‘bland menu’ of exchange-traded funds (ETFs) and mutual funds because they couldn’t afford a wealth manager. Meanwhile, accredited investors had a secret menu of hedge funds, VC, etc. This divide frustrated us, so we built Titan.”

Titan grew by 500% in the last 12 months, largely organically, as daily investors turned to the platform searching for active investment management with out possessing to do it themselves. Titan is expecting to cross its 1st $1 billion in assets beneath management later this year,

just more than 3 years immediately after launch.

Acharya mentioned that Titan is reinventing investing for the Millennial and Gen Z generations, and it is adding transparency and the chance to understand. Of course, other individuals are ahead in some respects. Robinhood is preparing to raise $35 billion in an initial public supplying. While Robinhood promotes do-it-your self investing, Titan focuses on in-residence management of capital on behalf of customers whilst walking them by means of the actions of investing as they go.

Titan Crypto

Image Credit: Titan

Titan’s cryptocurrency will be launching quickly. And it will be the 1st and only actively managed portfolio of cryptocurrency assets (quickly) out there to U.S. investors, the corporation mentioned. The method seeks to invest in a concentrated basket of crypto assets that can outperform more than a lengthy-term time horizon.

It is actively managed by Titan’s in-residence crypto investing group. At launch, Titan Crypto will be out there to all U.S. residents except these with home addresses in New York. Access for New York residents will be offered after Titan’s custodial companion receives regulatory approval for the state’s jurisdiction.

How Titan operates

Investing by means of Titan is meant to be straightforward. After a swift sign-up, customers pick to location their capital in one or more of Titan’s present investment methods, like Flagship (significant U.S.-based organizations), Opportunities (compact and mid-size U.S.-based organizations), Offshore (international organizations), and Crypto (concentrated basket of crypto assets). Titan’s minimum investment is $one hundred, and each accredited and non-accredited investors can join. There are zero overall performance-based costs and no lock-ups. Each method is rigorously actively managed by Titan’s in-residence investment group.

Titan customers also personal the underlying fractional shares of the companies in every investment method, supplying higher flexibility when compared to pooled automobiles like hedge funds and mutual funds.

“The mutual fund or an exchange-traded fund (ETF) is fundamentally just a piece of technology for an investment manager to accept money from someone in order to invest in securities like a basket of stocks,” Percoco mentioned. “We think this piece of technology is like a VHS tape. It does the job, but it’s archaic for a few reasons.”

The investment manager can not speak to the client. A mutual fund is a black box. This is poor for a lot of motives, he mentioned. On major of that, the investment manager has no concept who the client is. When you invest in an ETF, you are just an anonymized dollar worth, Percoco mentioned.

And these items have layers of fees, have higher minimums, and are tough to make, he mentioned. The factory that creates the mutual fund itself is quite old.

“Believe it or not, the entire investment management industry (i.e., the use case of someone giving their money to an investment expert) is predicated on these VHS tapes,” Percoco mentioned. “These are the archaic technologies being used. We’re rebuilding it entirely. Fidelity is an old factory. Titan is effectively a new factory.”

With Titan, investment managers can speak to customers (see the in-app video messages they send to clarify market place circumstances). The customers are not anonymous and so Titan can personalize investment suggestions for them. And Titan’s items can be designed more quickly, improved, less expensive,” he mentioned.

“Like investment giants before it, the initial strategies on Titan’s platform are predominantly in stocks (for instance, its large cap growth strategy called “Flagship” aims to be a contemporary version of the revered Magellan Fund),” he mentioned. “We’re already getting in-bounds from multi-billion dollar managers asking to launch products on Titan.”

Titan was founded by Clayton Gardner, Maxwell Bernardy, and Percoco. The corporation has 30 personnel, and it hopes to have one hundred a year from now.

/cdn.vox-cdn.com/uploads/chorus_asset/file/24401977/STK071_ACastro_apple_0001.jpg)

/cdn.vox-cdn.com/uploads/chorus_asset/file/25416470/Screenshot_2024_04_24_at_4.05.11_PM.jpeg)